The client discovery process is where you lay the groundwork for success. When the process is managed well, it provides you all the essential information you need to offer strong guidance and have productive conversations with your clients.

But for advisors shifting from an asset or portfolio management role into financial planning, what discovery should look like may not be intuitive. ECF Discovery was designed by founder Sergio Campos to create a simple, repeatable system any advisor can use to gather the client information they need. With over a decade of experience in the financial advisory space and a certificate in Personal Financial Planning from the UC Berkeley Extension, Sergio brings his expertise to bear in the ECF Discovery workflow.

Financial planning fundamentals: The seven questions that define a plan

To craft a financial plan, you need to answer seven fundamental questions. They help you understand a client’s financial history, their current status, and what they need to do to reach future goals.

- Can you withstand a sudden negative financial disruption to income (such as unemployment or loss of a significant asset)? Do you have enough emergency savings?

- Can you meet short-term debts?

- Are you managing debt well?

- Are you saving enough?

- What is your net worth?

- Are you making satisfactory progress toward funding retirement?

- Are you making a satisfactory total return on investments and savings?

The ECF Discovery process ensures advisors walk away with clear insights from clients to answer each of them.

The ECF Discovery process: How it works for advisors

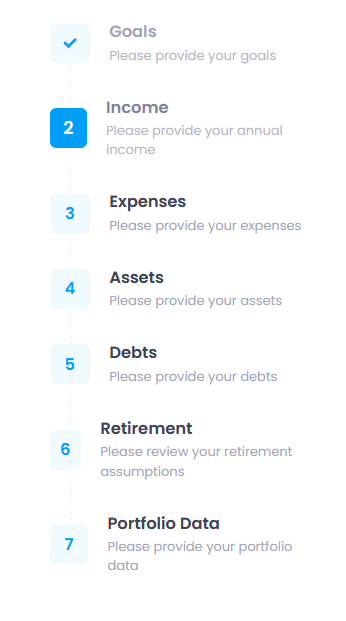

To generate answers to these questions, the ECF Discovery process guides advisors through a simple, repeatable workflow. The seven-step process mirrors the seven questions you need answered. And we’re constantly listening to feedback from clients and adjusting the process to address their needs.

Here’s a closer look at the process and how it works.

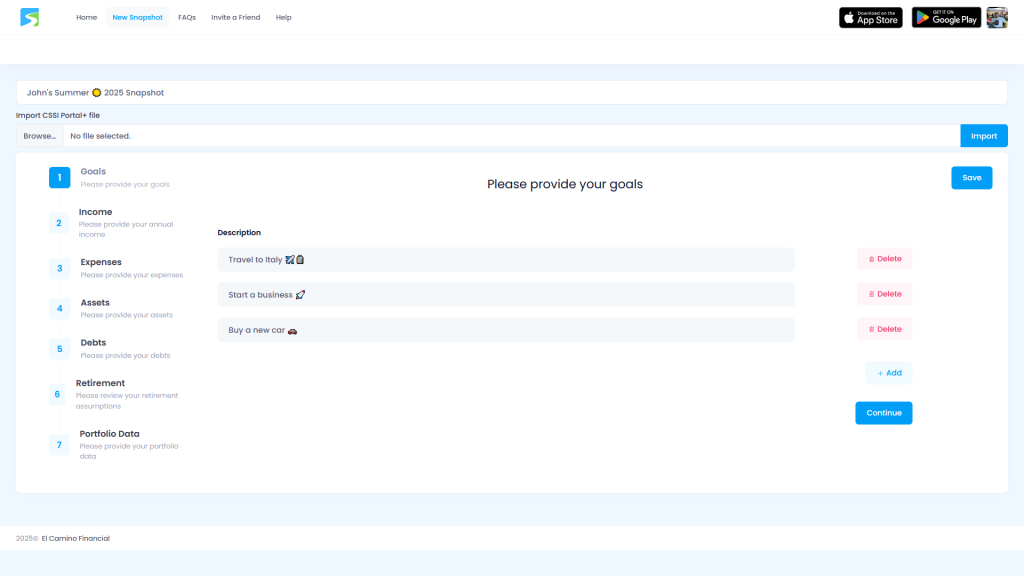

1. Goals

Any great financial planning conversation begins with goal-setting. You want to help your clients reach their big dreams — to do that, you’ve got to know what they are first.

ECF Discovery’s Goals feature allows you to define and capture concrete objectives for each client. These may be big things, like finally paying off that college debt, or smaller goals, like funding a European vacation.

Starting here is a way to build rapport and trust before you dive into the details with hard numbers in the following sections.

No matter the size of the dream, there’s space to capture it here.

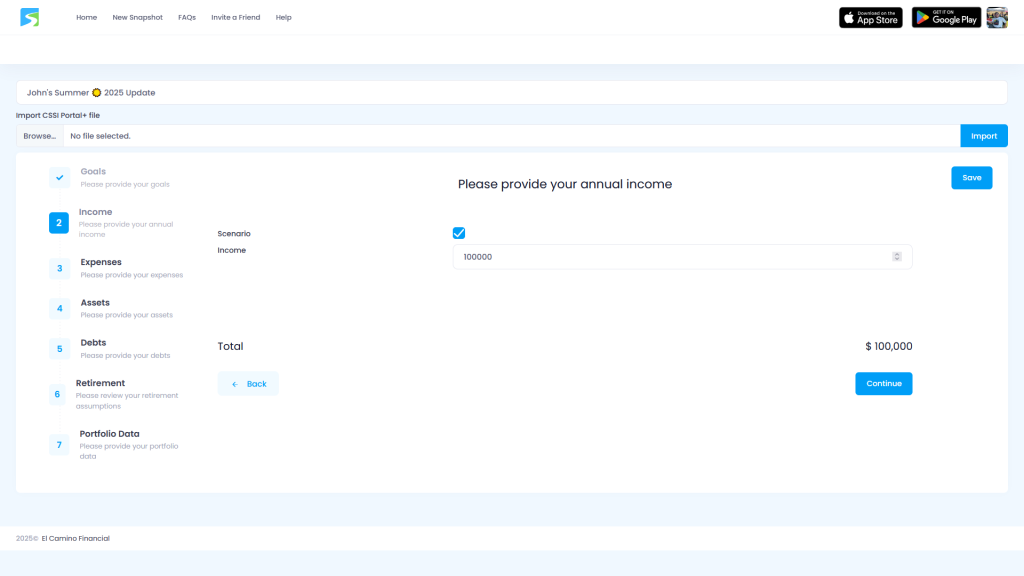

2. Income

The next area of focus is income. Your working-age clients likely hold a job, but there are plenty of other potential streams of income. To devise a solid plan, you need to know about them all. The income section of ECF Discovery is a place to record income from a range of sources, including W-2 income, rental properties, and more.

3. Expenses

On the flip side of income is expenses. How much money is going out the door each month, and can your client’s current income sustain monthly expenses while allowing them to work toward long-term goals?

Capturing all of your client’s expenses in the ECF Discovery platform ensures you have that information available to you in the planning process.

4. Assets

Assets represent your client’s hard earned gains — from liquid assets, like public stocks, to illiquid holdings, like real estate. The assets section is a place to go line-by-line and dive into all of your client’s holdings.

5. Debts

After collecting the list of assets, you’ll want to understand any liabilities your client is responsible for. Again, ECF Discovery makes it easy to capture information about a range of debts, including mortgages, car loans, consumer debt, student loans, and more.

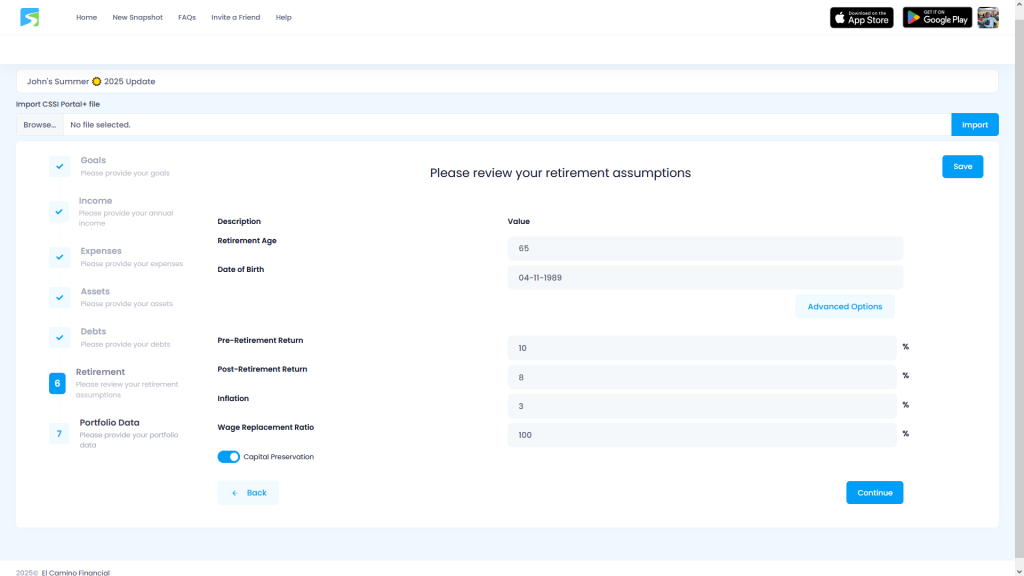

6. Retirement

For many clients, a major driver in working with a financial advisor is finding someone to help guide them toward a secure, sound retirement. Capturing information about your client’s retirement goals — from when they plan to retire to how much they expect to need — can help you form a concrete and actionable plan for working toward those goals.

Within the retirement section, take advantage of the advanced planning retirement calculator, which invites you to try different methodologies to generate a retirement savings goal. Input key retirement assumptions, including target retirement age and wage replacement ratio.

You can always go back and adjust numbers to test different scenarios and help clients find a sustainable path toward saving for the life they want in retirement. Plus, with the scenario checkbox, you can mark a given snapshot as a scenario and invite your clients to compare different versions of their financial future side-by-side.

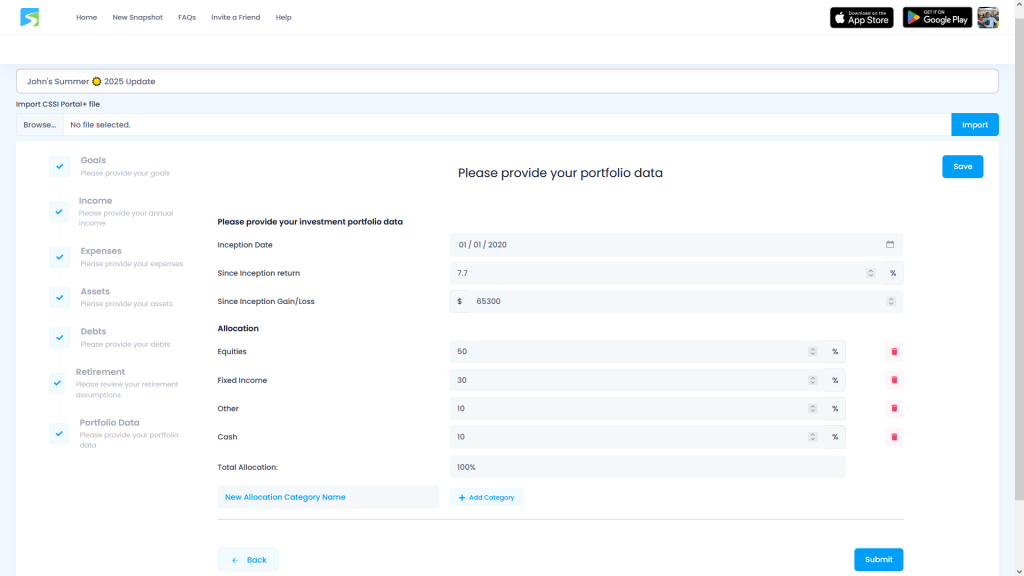

7. Portfolio Data

Last up in the seven-step process is portfolio data. With many clients holding accounts across various custodians, it’s essential you create a complete picture of their portfolio in one location.

The ECF Discovery platform allows you to manually enter all portfolio data — no establishing onerous and error-prone connections through third-party tech platforms.

***

ECF Discovery makes it easy to go at a pace that works for you and your clients. At any point in the process, you can save your progress or jump between sections to make updates or adjustments.

ECF snapshots allow you to name and save the outcomes of the discovery work, so you can capture this moment in your client’s financial life. As their circumstances change, you can always adjust the information in the platform, but a snapshot of this current moment will remain accessible to you and your client.

Are you ready to implement an easy, effective, and repeatable discovery process with your clients? Schedule a demo to see the platform in action, or email us at hello@elcaminofinancial.com to learn more.

Want to try ECF for yourself first? Register for a free individual account: https://elcaminofinancial.com/register.