Introduction:

Retirement is a highly anticipated phase of life, but it necessitates careful planning and financial management. One of the key elements in this process is determining the amount you should save today to ensure a secure and comfortable future. In this blog post, we’ll explore how ECF streamlines this planning. Before we delve into the details, ensure you’ve registered with ECF to initiate tracking your finances. If you haven’t registered yet, you can do so here. We recently created a video covering this topic and if you prefer to watch the video, you can do so here.

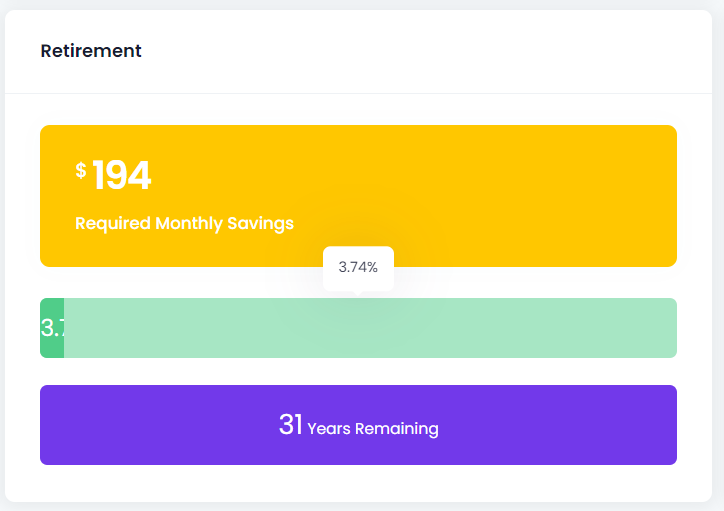

You might recognize this section from your ECF Snapshot Dashboard, dedicated to guiding you toward your retirement goals. It comprises three critical components:

- Monthly Savings Goal: This indicates the recommended monthly savings amount to aim for.

- Total Savings Progress: A visual progress bar showcasing your journey towards your retirement savings goal.

- Years Until Desired Age: This shows the number of years left until your desired retirement age.

Behind the scenes, ECF employs a calculated approach using the information you’ve provided to determine your required savings. Let’s dive deeper into how this calculation is executed.

Factors in the planning:

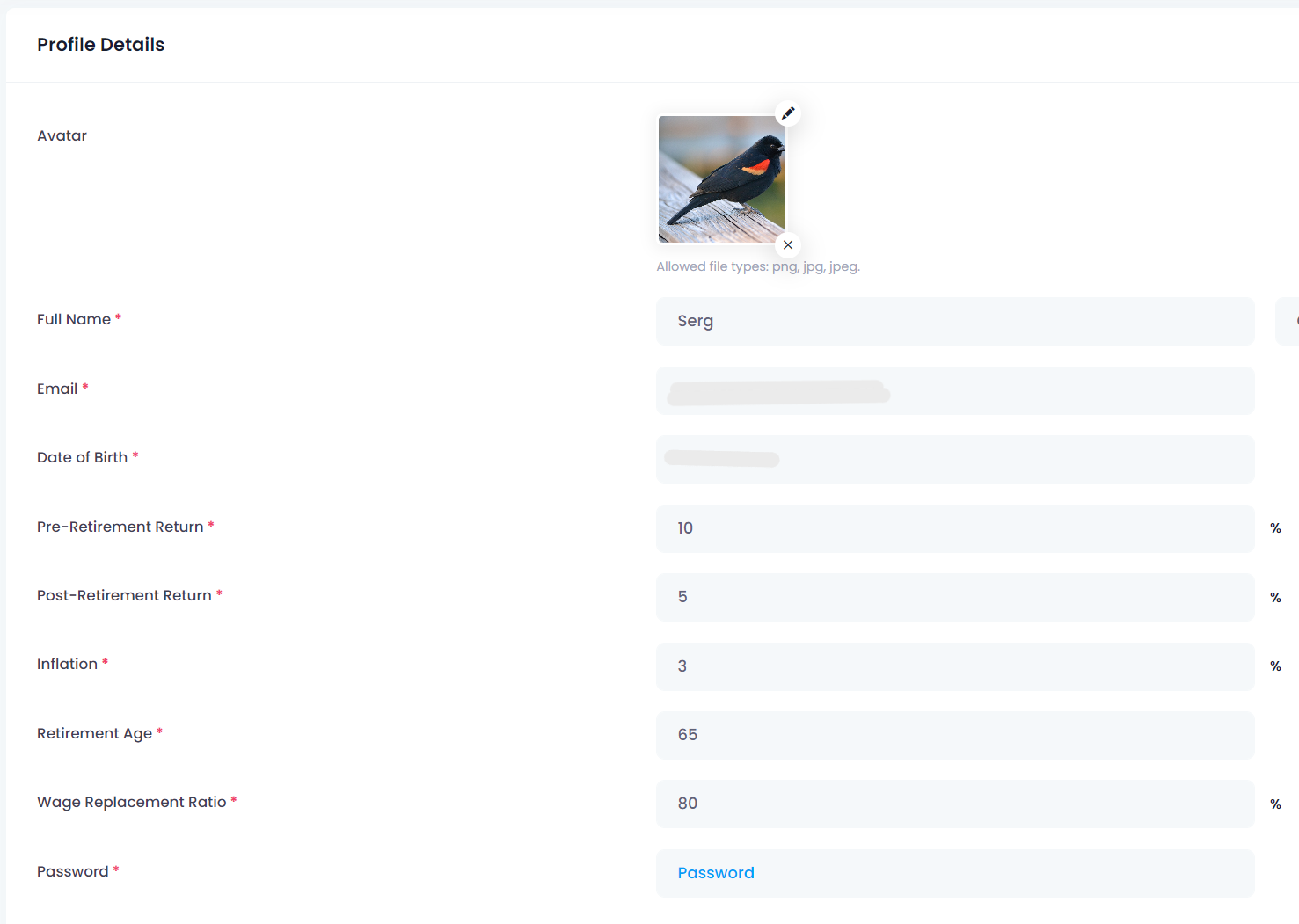

- Retirement Age: Your chosen retirement age significantly influences your savings needs. Generally, earlier retirements demand higher savings. ECF defaults to a retirement age of 65 in its calculations.

- Estimating Expenses and Income: Predicting your retirement expenses and necessary income can be intricate. It involves considering potential changes such as healthcare costs, travel, and hobbies. ECF assumes 80% of your current income as a benchmark for a comfortable retirement.

- Factoring in Inflation: Accounting for the impact of inflation on the cost of living is crucial. ECF utilizes a 3% inflation rate to ensure your retirement savings remain adequate over time.

- Considering Investment Returns: The expected return on your investments plays a pivotal role in your retirement savings plan. Higher anticipated investment returns can reduce your required savings amount. ECF applies a default return rate of 10% for both pre- and post-retirement phases.

Unsatisfied with the calculation assumptions? You have the flexibility to customize them in your Profile Details. Simply click your profile photo in the top right corner, then select “My Profile.” Here, you can update your calculation assumptions.

What if You Already Have Retirement Savings?

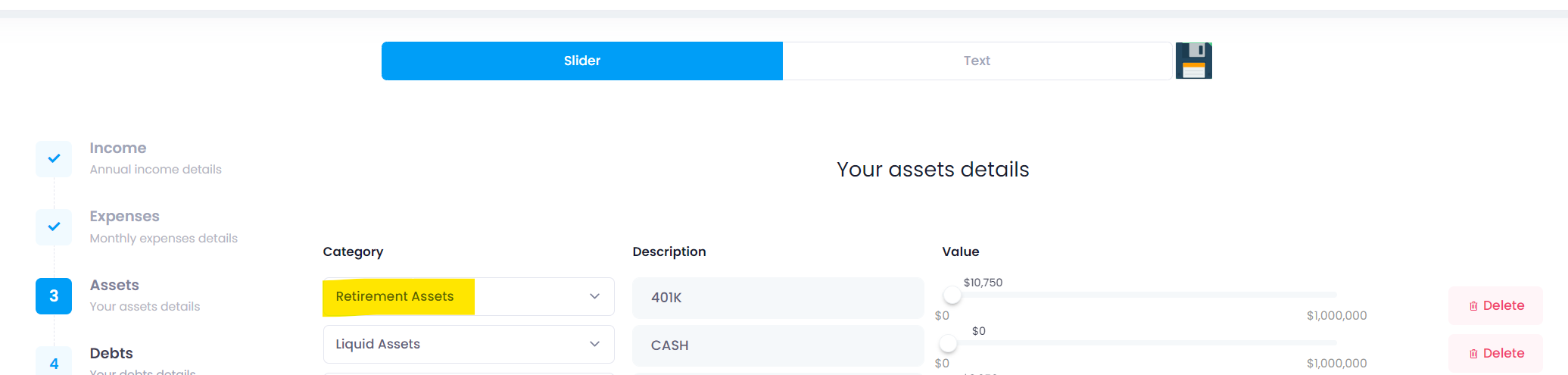

If you already possess savings in an account, ECF takes these assets into account, provided you include the relevant information in your data entry.

To ensure accurate calculations, it’s crucial to label your assets appropriately so that we can incorporate your current savings into the calculation.

Planning involves various intricate factors that demand thoughtful consideration. By determining your retirement age, estimating expenses and income, accounting for inflation, and considering investment returns, you can construct a savings plan aligned with your financial goals, securing a comfortable future. ECF is your trusted partner in maintaining this course towards financial security and a prosperous retirement.