ECF Joins Personal Finance Podcast Strive to FI w/ Joseph Hadaway

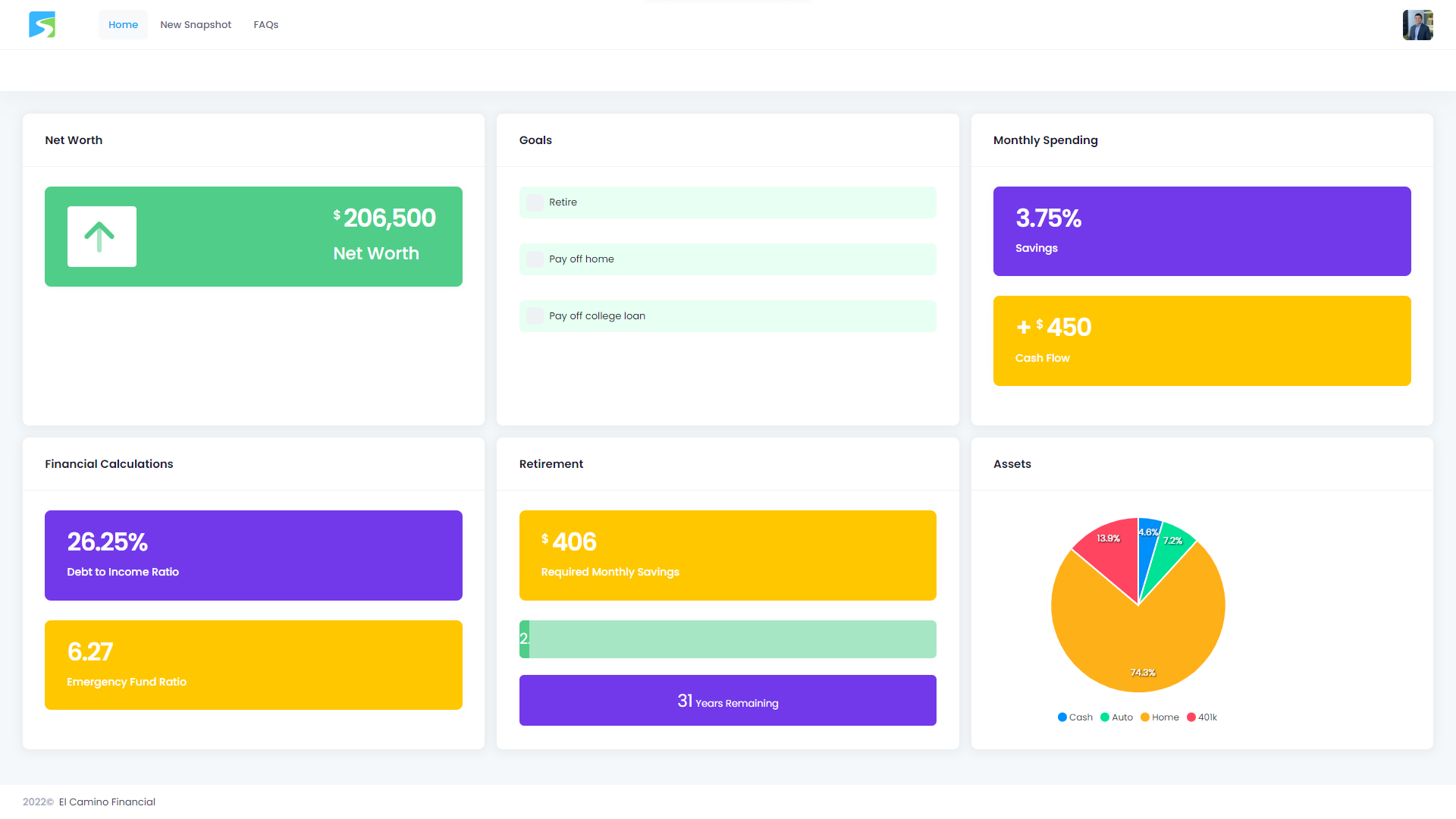

ECF’s Sergio Campos had the pleasure of joining Joseph Hadaway on his Podcast Strive to FI. Strive to FI is a podcast focused on personal finance. In this episode of Strive to FI, Sergio shares the story of ECF and what makes it the best personal finance app on the market! If you have not signed up for ECF, you can register today at https://elcaminofinancial.com/login. You can watch other great episodes of Strive to FI at http://www.youtube.com/@strivetofi. Enjoy!

ECF Joins Personal Finance Podcast Strive to FI w/ Joseph Hadaway Read More »