Now that we’ve explored the founding story of ECF, it’s time to introduce you to our powerful personal finance app. Our app not only generates a snapshot of your financial status but also tracks your financial journey over time. This financial snapshot is built upon essential calculations employed by financial advisors to assess financial strengths and weaknesses. In forthcoming posts, we’ll delve into each calculation in detail. In the meantime, you can find a summary of these calculations in our FAQ section. Today, let’s focus on how you can create your inaugural financial snapshot. Before we proceed, make sure to register for a free ECF account here.

Onboarding with ECF – Here we have a prerecorded video if you prefer to watch it. We have made a few updates to our application since the making of this video but it still provides you all the information you need to generate your first financial snapshot.

Welcome to the start of your ECF personal finance journey! 😊

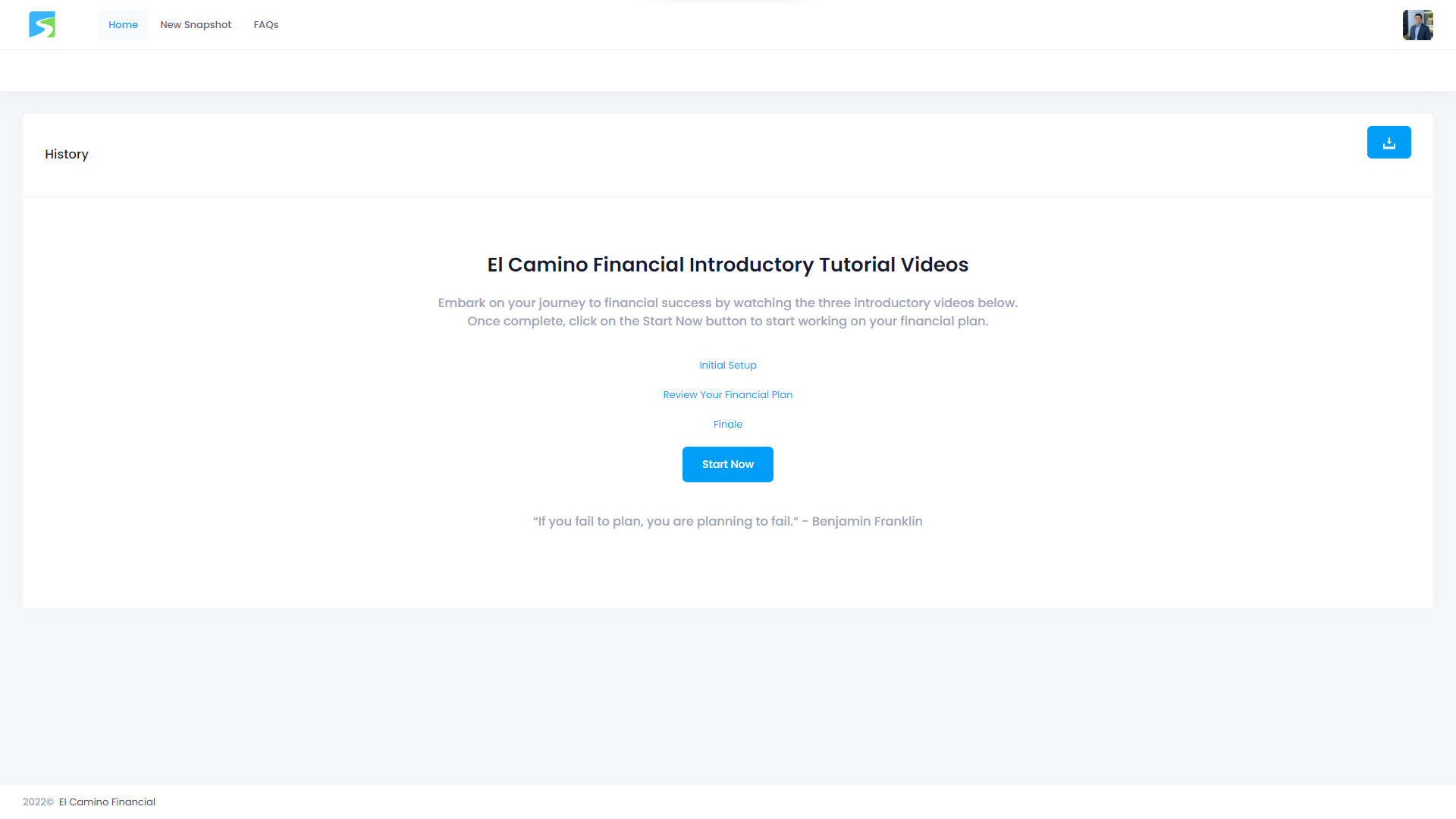

Upon your initial login, you’ll land on the Home page. Here, you’ll find a warm welcome message and links to introductory videos about ECF. You can choose to watch the videos or continue reading this post. Feel free to navigate around the platform and familiarize yourself. When you’re ready, click “Start Now” to begin creating your financial snapshot.

Important Notes Before We Begin:

Before we dive into crafting your first financial snapshot, here are a few important points to note:

- You’ll be asked to provide details about your income, expenses, assets, debts, and financial goals.

- This process typically takes between 15 to 30 minutes, depending on the complexity of your financial situation.

- Your data will be saved, allowing you to make updates and adjustments as needed in the future.

- You don’t have to complete this in one sitting; you can save your progress and return later to finish.

- Use the left-hand menu to navigate between sections.

- Approximate values are acceptable; you don’t need to be extremely precise.

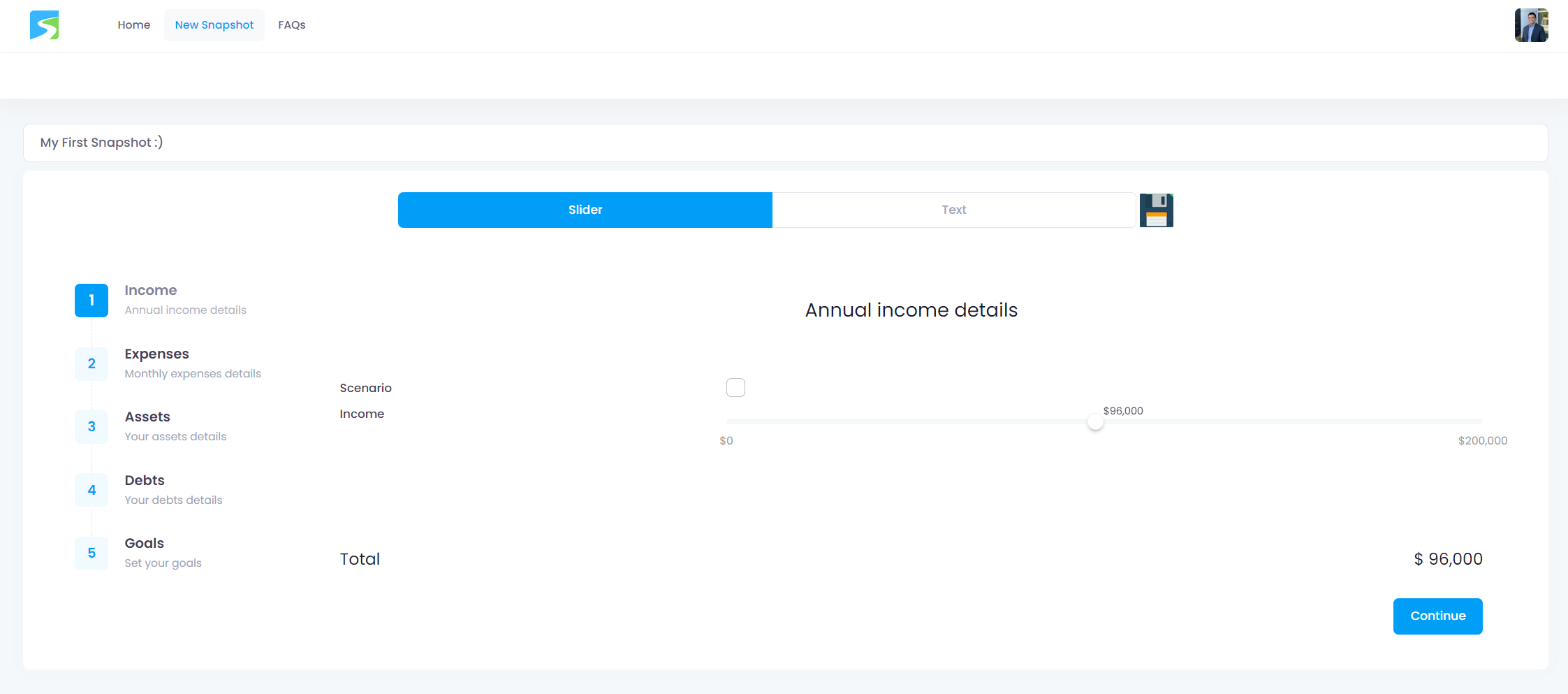

- Don’t forget to give your snapshot a name in the designated field at the top. For instance, we’ve named ours “My First Snapshot 😊.”

- You can ignore the “Scenario” checkbox for now.

Now, let’s proceed to each section:

Income

After naming your personal finance snapshot, please provide your income details, then click “Continue.”

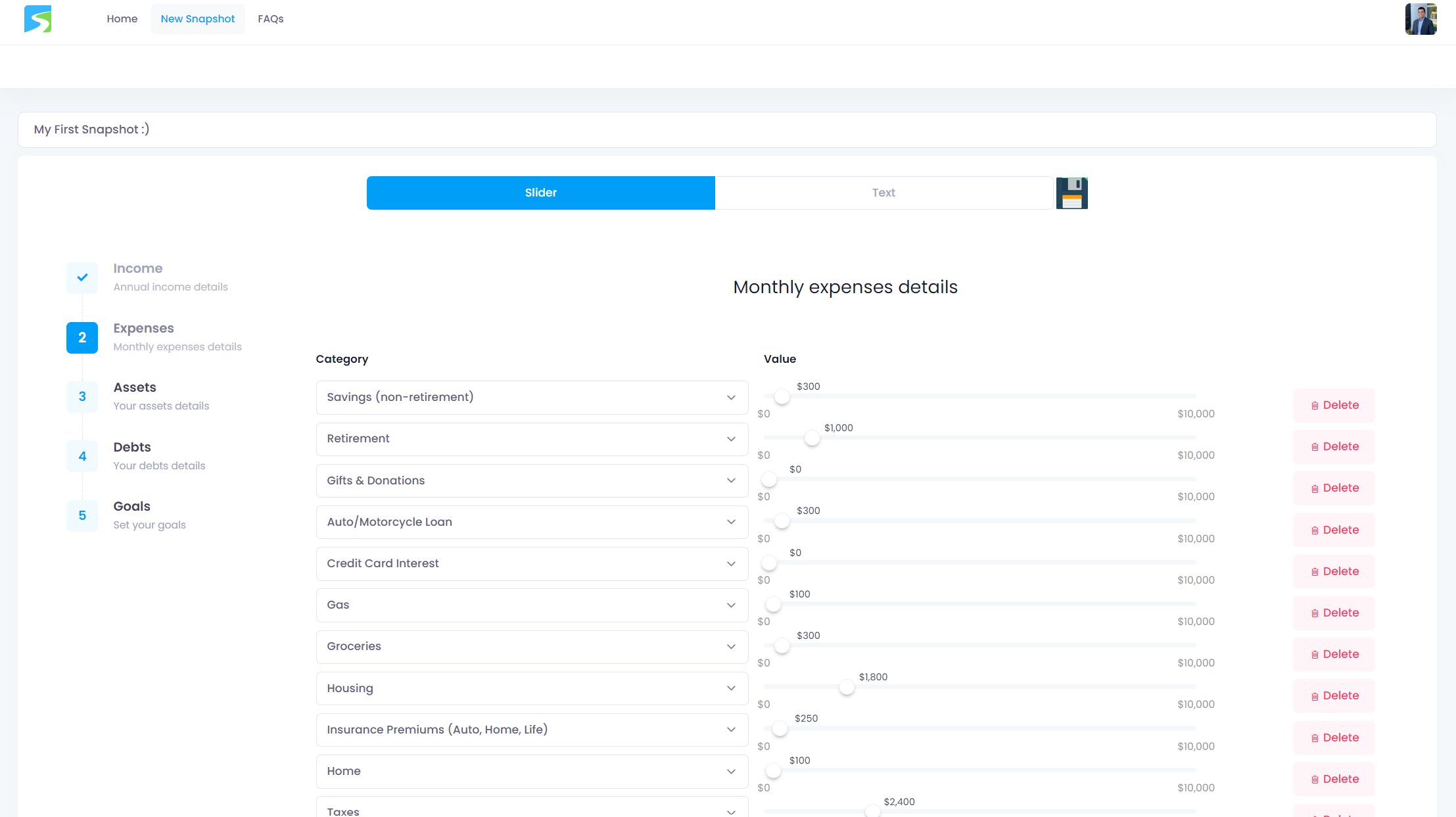

Expenses

Provide your expenses, and feel free to review the list to see if there’s anything that doesn’t apply to you, which you can delete.

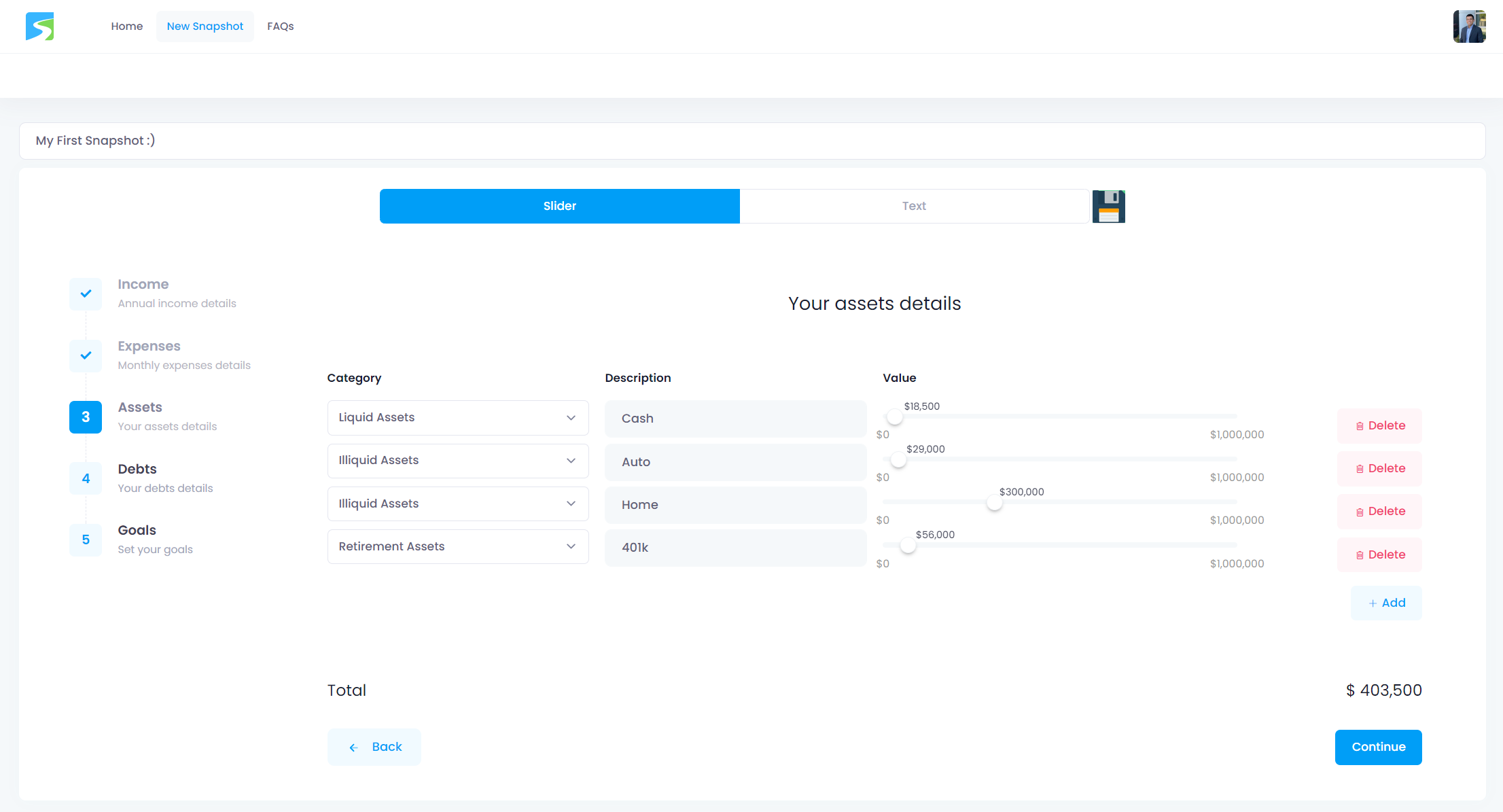

Assets

Next, you’ll enter your assets, categorizing them as “Liquid,” “Illiquid,” or “Retirement,” along with descriptions and values.

- Liquid Assets: Assets quickly convertible to cash (e.g., cash, money market instruments, marketable securities).

- Illiquid Assets: Assets not easily converted into cash (e.g., property, jewelry).

- Retirement Assets: Assets held in retirement accounts (e.g., 401k, IRA).

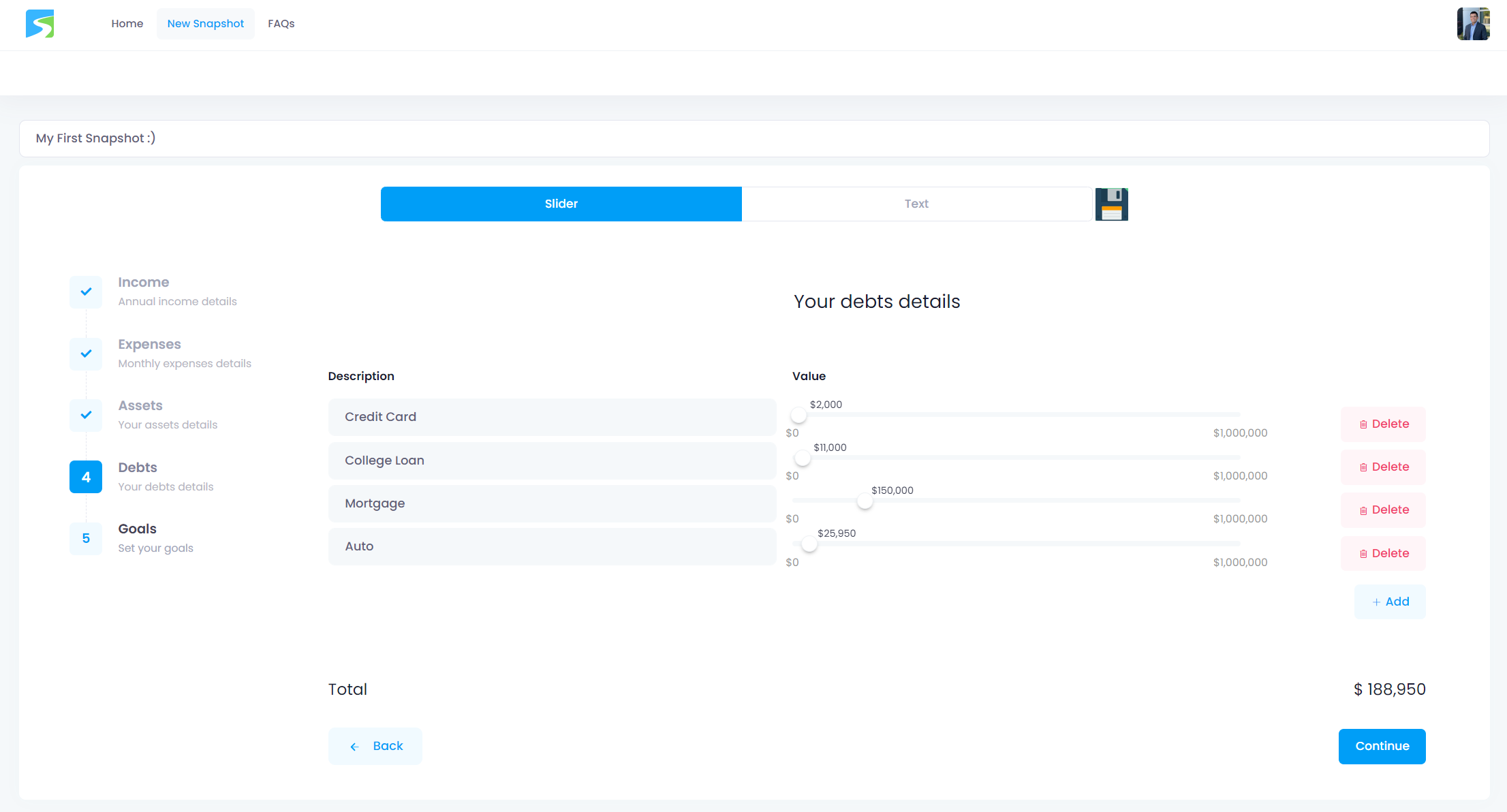

Debts

Provide details about your debts.

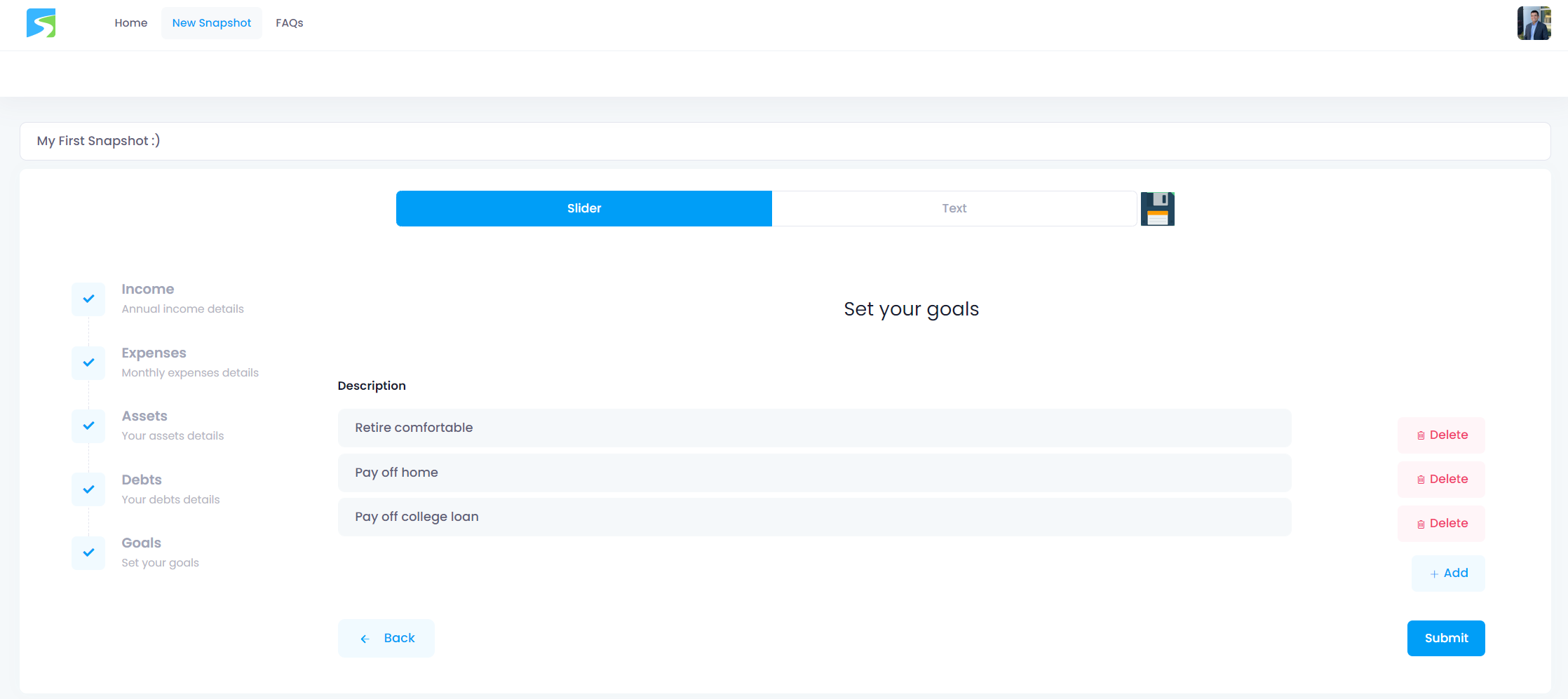

Goals

Lastly, share a few financial goals that serve as reminders of why you’re working to improve your finances.

Submit

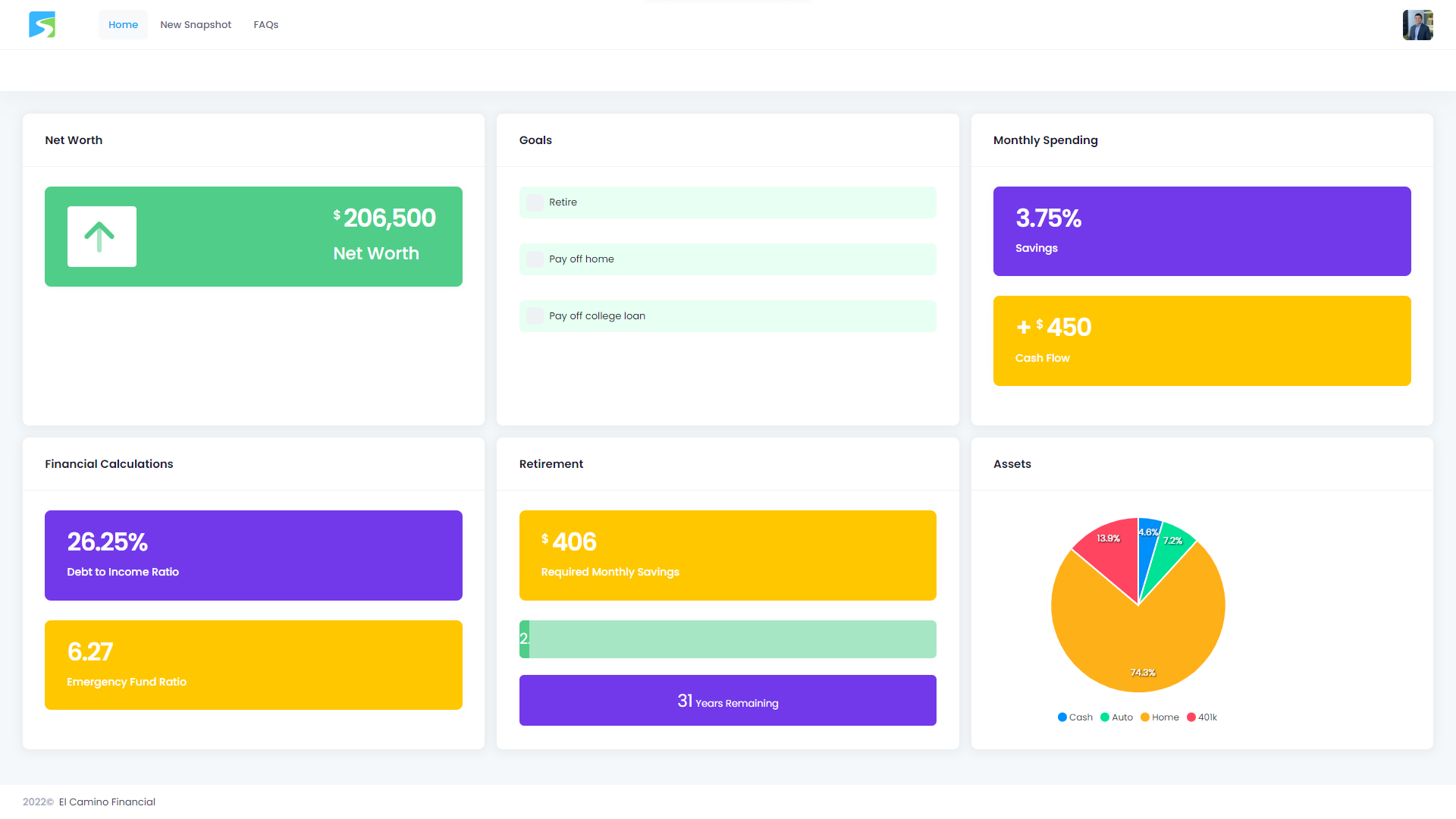

Once you’ve completed the sections, click “Submit.” Your financial snapshot will be instantly generated and will resemble the example below:

Voila! You now have your first ECF snapshot.

Stay tuned for our next post, where we’ll explore the importance of each section in your personal financial snapshot and continue our tour of ECF.

Thank you for your support and interest in ECF! – SC