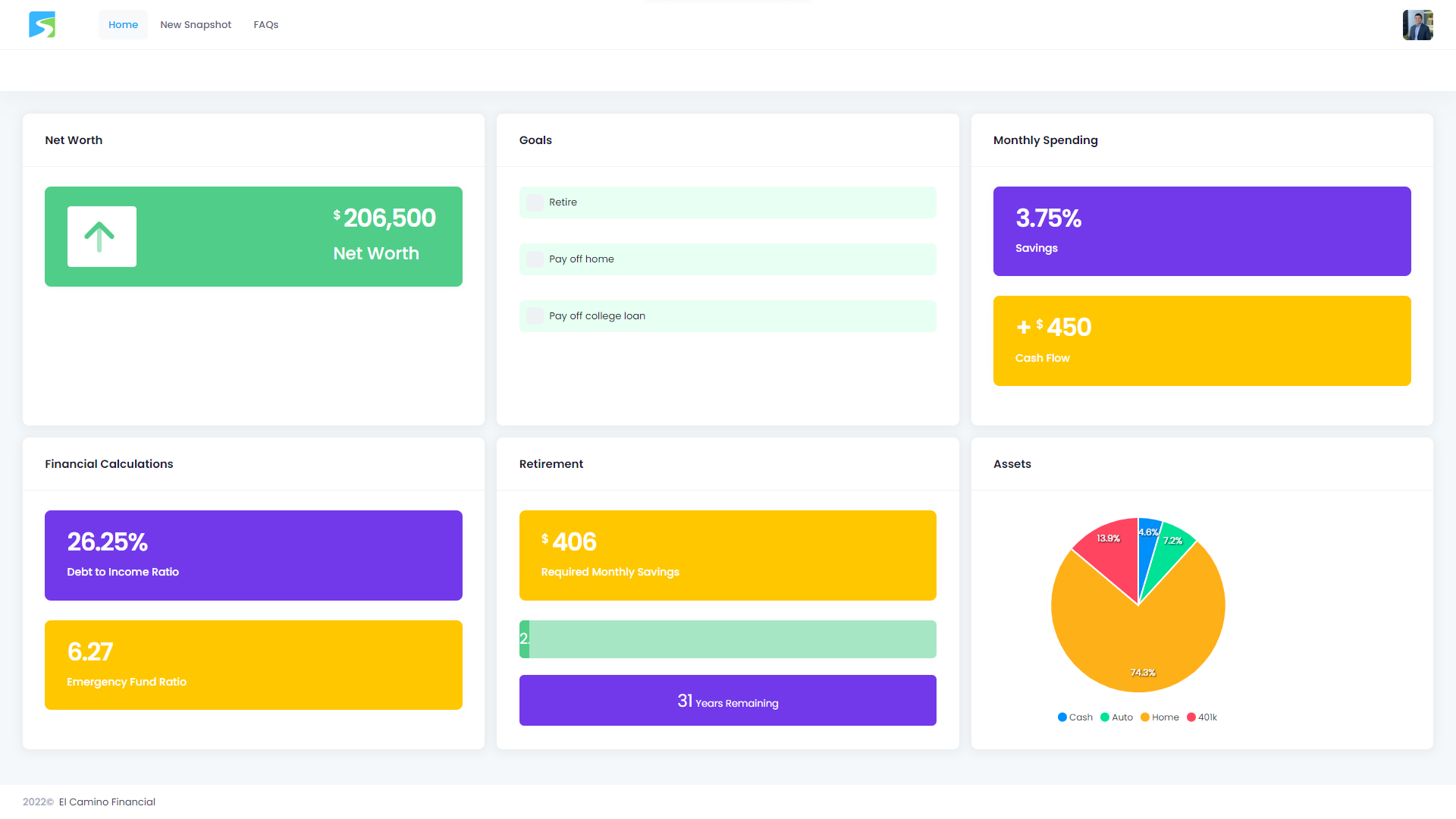

In our previous post, I discussed how to get started on creating your first ECF financial snapshot. If you haven’t created an ECF account, you can do so here: https://elcaminofinancial.com/login. It’s free! In this post, I will discuss the difference between a financial plan and an ECF Snapshot. At first glance, it may seem the dashboard consist of a bunch of random calculations but each one serves as a valuable tool to help you achieve your goals.

How do I know these calculations are useful? I have been working with financial advisors for 10 years now. I have also earned a certificate in financial planning from the UC Berkeley Extension program. In the financial advisor industry, advisors create financial plans for their clients. A financial plan is a comprehensive overview of an individual’s current financial state and a detailed plan for how to meet their financial goals. A financial plan serves as a roadmap to financial success and is vital for achieving financial security and stability. Financial plans often contain calculations to provide further insights into a client’s financial standing. The calculations shown in the ECF financial snapshot dashboard are calculations often used in a financial plan. Financial plans also contain client goals.

You can think of an ECF financial snapshot as a compact version of a financial plan.

Now that I have covered the story behind the ECF snapshot dashboard, let’s dive into the specifics of each section and calculation. I also want to add, you can also find the following information within the ECF app under the FAQ section: https://elcaminofinancial.com/faqs.

About the Net Worth calculation

Net Worth is an important financial calculation in the financial planning world. It is also a simple calculation:

Assets – Liabilities = Net Worth

A positive net worth means you have more assets than debts. This is a good thing and means you could pay off all your debts if you needed to. A negative net worth means your debts exceed your assets. Negative net worth means you would not have enough to pay off your debts even you sold all your assets. A positive net worth is one of many indicators of financial strength.

About the Goals section

The purpose of the goals section is simply to remind you why you are working towards improving your finances. The purpose of financial planning is to align your finances to achieve your goals.

About the Savings calculation

This calculation presents your monthly percentage of savings and here is the calculation:

Monthly Savings/Monthly Gross Income = Savings Percentage

It’s very important to set aside funds for your emergency fund if you don’t have one already. If you already have a sufficient emergency fund (3-6 months of expenses), the savings should be used towards funding your goals.

About the Cash Flow calculation

Cash Flow tells you if you are spending more than you are making and vice-versa and is calculated as follows:

Monthly Gross Income – Monthly Expenses = Cash Flow

A positive cash flow means you are making more money than you are spending. This is a great place to be! The alternative is negative cash flow which means you are spending more than you are earning. This could be fine in the short term but in the long term, it may result in an increase in debt.

About the Debt-To-Income calculation

The Debt-To-Income Ratio calculation tells you what percentage of your spending goes to debt and is calculated as follows:

Monthly Debts/Monthly Income = Debt-To-Income Ratio

Your Debt-To-Income Ratio is important when applying for loans. 43% or lower is a comfortable place to be and what lenders like to see. Staying around 43% and below puts you in a better position to receive a favorable interest rate as well. Anything above 43% may mean you are in a risky position and that a high percentage of your income is going towards debt. This could result in being offered higher interest rate loans or at risk of not qualifying for a loan.

About the Emergency Fund Ratio calculation

This calculation will tell you how many months you have in emergency savings and is calculated as follows:

Liquid Assets/Monthly Total Expenses = Emergency Fund Ratio

It’s very important to have funds set aside in case of an emergency. 3-6 months or more of your monthly expenses is ideal. Unexpected expenses can occur at any moment and delay reaching your goals. Having emergency funds will minimize the impact an unexpected expense will have on accomplishing your goals.

About the Retirement calculation

The retirement calculation shows a suggested monthly savings goal and progress bar towards the retirement funding goal, which is how much you need at retirement to replace your current income. Suggested monthly savings goal is calculated using a financial planning calculation known as the Pure Annuity Model. The calculation assumes that you will need 80% of your current wages. It also assumes retirement at age 65, a 10% portfolio return, 3% inflation and a life expectancy of 78 years old. Don’t agree with our assumptions? You can adjust your retirement assumptions under your profile settings!

That concludes this post. I hope you enjoyed learning about the ECF dashboard and how it can help you make better financial decisions. Just like a financial plan, ECF summarizes your finances, goals, and identifies strengths/weaknesses. If you haven’t signed up, don’t forget to sign up for a free account today!

-SC